In this episode of Under the Hood, the main things we are watching are market strength and breadth, inflation, interest rates, and Federal Reserve activity .??

In this report, you will see charts and notes that highlight some of the most important trends we are following, such as: ?

- Money Supply?

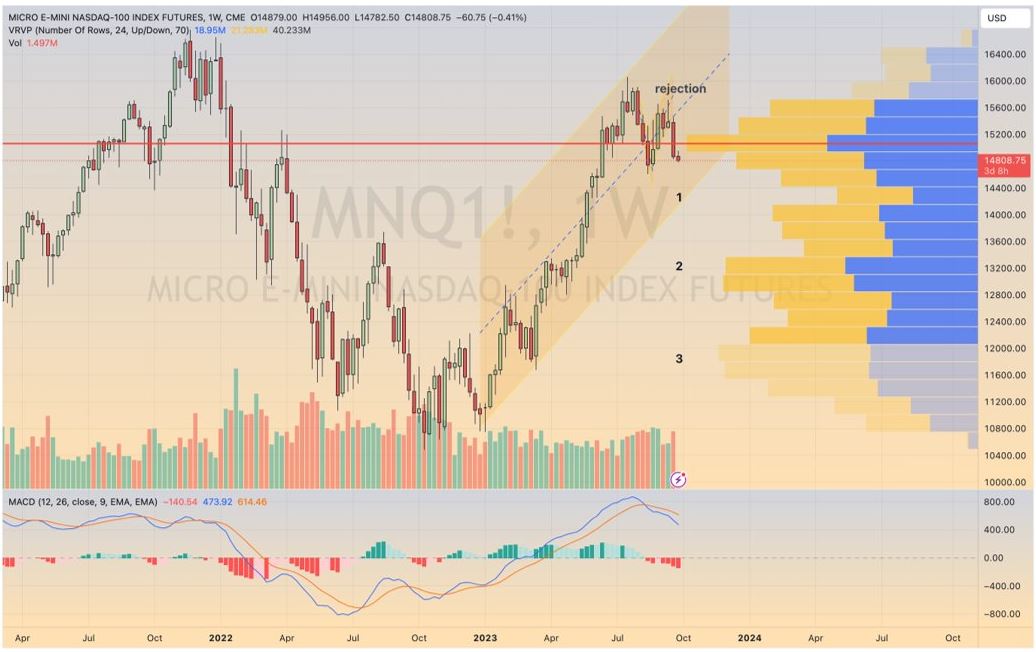

- Nasdaq??

- NYSE Advance Decline??

- FAANG??

- Bullish Percent ??

- Fed Action??

- Sector Overview?

We are seeing an actual shrinking of M2 for the first time since the early days of the Great Depression. A shrinking M2 and a negative rate of change in the money supply are strong economic indicators that can have serious consequences for an economy.

It looks like this could be the beginning of a breakdown in the NASDAQ trend signaling a shift in market dynamics.?

The Oct ’22 low, the ADV-DEC line (NYSE operating companies only) has followed a steady path up, adhering to the orange trendline. That trendline has been recently broken, indicating the declining issues are outpacing advancing issues at an increasing pace.?

FAANG, representing over 30% of total S&P 500 market cap, is also now rolling over. Representing over 30% of the market cap weighted S&P 500 and 60% of the Nasdaq 100 (NDX), this is now “our most important chart”, as a breakdown here will be felt far and wide.?

One of the most effective long-term market breadth tools for assessing risk and identifying differences in supply and demand in the market is the NYSE Bullish Percent Index.?

?

The NYSE Bullish Percent Index was developed by the founder of Investors Intelligence, Abe Cohen, in 1955, who was trying to create a contrary market indicator that was bullish at the bottom and bearish at the top.

We are seeing sentiment plummet to its lowest levels in over a year.?

The Fed’s asset purchases have clearly had an impact on the markets over the past 15 years, with major increases in purchases coinciding with a rising S&P 500. ?

We are currently witnessing a meaningful pullback in the size of the Fed’s balance sheet for the first time since the dawn of the QE age. ?

(Source – Trend Macro Data Insights)?

A super simple way to gauge market health and to know where to focus attention can be accomplished by ranking the basic asset classes using absolute momentum. ?

?

Absolute momentum requires that an asset class perform better than a risk-free rate of return. (The problem with using purely cross-sectional momentum is that you can own the prettiest falling knife).?